Planning a trip to Malaysia? Excitement is likely brewing, but amidst the anticipation, one crucial aspect deserves attention: currency exchange and money management. Understanding how to handle your finances during your Malaysia travel can ensure a smooth and enjoyable experience. Let’s delve into the world of Malaysian currency, explore different exchange options, and equip you with valuable money-saving tips.

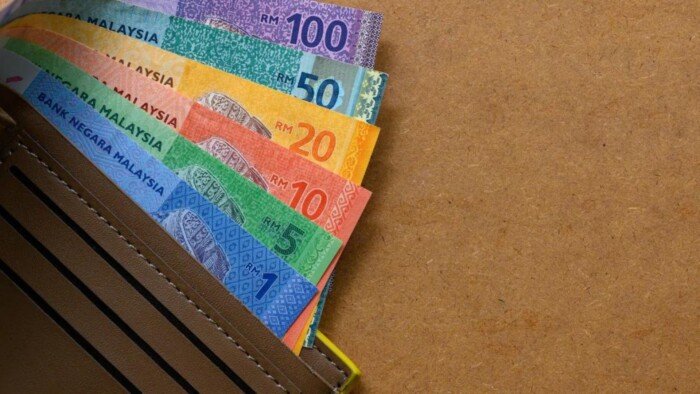

The Currency of Malaysia

Exchanging Your Currency

Several options are available for exchanging your currency to Malaysian Ringgit:

Before Your Trip

When preparing for your trip to Malaysia, it’s wise to explore currency exchange options available in your home country. Many banks and currency exchange offices offer currency exchange services, allowing you to obtain Malaysian Ringgit (MYR) before your departure or upon arrival in Malaysia. However, it’s essential to compare exchange rates and fees among different providers to secure the best deal.

Banks typically offer currency exchange services to their customers, with rates that may vary depending on factors such as the amount being exchanged and the type of account held. While banks are known for their reliability and security, they may charge transaction fees or impose minimum exchange amounts.

Upon Arrival

When travelling to Malaysia, it’s common to find currency exchange services available at airports and major tourist areas. These money changers cater to the needs of travellers by providing convenient access to Malaysian Ringgit (MYR) for immediate use upon arrival. However, it’s essential to be aware that exchange rates offered by airport money changers and those in tourist areas may be slightly less favorable compared to other options.

Money changers located at airports and popular tourist destinations often charge higher fees and offer less competitive exchange rates due to their convenient locations and the demand from travellers. While these services provide the convenience of exchanging currency upon arrival or in busy tourist areas, they may result in receiving a lower value for your money compared to alternative options.

ATMs

Widely available throughout Malaysia, ATMs allow you to withdraw Malaysian Ringgit using your debit card. Be sure to check with your bank beforehand to understand any associated fees or withdrawal limits.

Money-Saving Tips

Carry a mix of cash and cards

While smaller shops and street vendors might only accept cash, having a debit or credit card allows for convenient transactions at restaurants, hotels, and larger stores.

Utilize cashless payment options

Many establishments in Malaysia, especially in major cities, accept mobile wallets and contactless payments. Consider setting up these options for added convenience and potential security benefits.

Shop around for the best exchange rates

Don’t settle for the first exchange service you encounter. Compare rates at different money changers, especially if you’re exchanging a large amount of cash.

Be mindful of ATM fees

Inquire about potential withdrawal fees charged by your bank and the ATM operator before making a withdrawal.

Carry small denominations

Having smaller bills readily available will help make everyday purchases, tipping at restaurants, and navigating public transportation.

Consider budgeting and tracking your expenses

Set a budget for your trip and keep track of your spending to avoid overspending.

Additional Tips:

- Declare large sums of cash: If you’re carrying more than USD 10,000 (or equivalent) in cash, you are required to declare it upon arrival and departure from Malaysia.

- Beware of scams: While uncommon, exercise caution when exchanging money on the street. Opt for reputable money changers with clear signage and avoid individuals offering overly favourable rates.

Final Thoughts

By following these tips and understanding the currency exchange landscape, you can navigate your Malaysia travels with financial confidence and ease. Remember, a little preparation goes a long way in ensuring a stress-free and enjoyable adventure!